Value – The First Variable in Your Selling Equation By Brian Goodhart Value is the first variable in your selling equation and for good reason – it is the one talked about the most and the metric by which most people determine the success or failure of a deal. In order to adequately discuss value, …

Tag: valuation

Credit Unions: Valuation and M&A Transactions

Whether due to merger, expansion, or investment, an understanding of the processes and techniques of valuation is crucial for the effective growth and solid financial performance of credit unions. Capstone Managing Director John Dearing and Manager Anna Kochkina break down the multifaceted valuation process in CUInsight. https://www.cuinsight.com/credit-unions-valuation-and-ma-transactions.html

Credit Unions: Valuation Process Steps

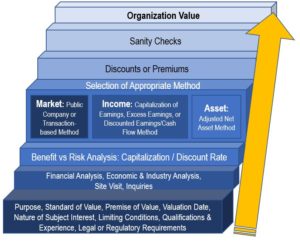

With the rising number of credit union mergers, the increasing interest in acquisitions of community banks and branches, as well as investments in fintechs by credit unions and CUSOs, understanding valuation – processes and techniques – has become increasingly crucial for successful growth and solid financial performance. Valuation Process Steps Highlighted below are some of …

Valuation of Today’s CUSO: Capstone Interview on CUbroadcast

Capstone’s John Dearing recently spoke to Mike Lawson of CUbroadcast at the 2018 NACUSO Network Conference. The interview covers key points from John’s breakout session with Guy Messick “What Is Your CUSO Worth? Valuation for CUSOs and Marketplace Trends.” In case you missed the live interview, you can watch the recording on the CUbroadcast website. In this …

Does the Highest Bidder Always Win the Deal?

The short answer to this question is no. Some owners may sell to the highest bidder, but this is not always the case. Differentiating by price alone is problematic for a number of reasons, the most obvious being that someone can always outbid you. In addition, when it comes to privately-held transactions, especially, we find …

What Is Your CUSO Worth? Find Out at the 2018 NACUSO Network Conference

Are you planning to sell or buy ownership units in a CUSO? Are you making an initial offering for a new CUSO? Are you an existing company that intends to become a CUSO by selling ownership units? Will your CUSO buy a business or merge with another CUSO? If any of these situations applies to …

How to Navigate Today’s High Valuation Multiples

Valuation multiples in the middle market are “unprecedented” due to low interest rates, relatively cheap debt available in today’s market, and high amounts of dry powder chasing the same deals. According to GF Data, average valuations reached 7.4 times, the highest quarterly mark the data base has recorded in 15 years. With such high valuations, …

Will Your Acquisition Fall Apart?

While it’s an important milestone, a signed letter of intent does not guarantee a successful acquisition. Just ask Pfizer who withdrew its $150 billion bid to acquire Allergan after signing a LOI. Pfizer ended up paying a breakup fee of $150 million. After the LOI is signed, you still have a few major steps to take before the acquisition …

How to Verify an Acquisition Target’s Unaudited Financials

Obtaining audited financial statements is always best when valuing an acquisition prospect. An audit enhances your confidence and ensures what management has presented is a “true and fair” view of the company’s financial performance and position. We run into plenty of privately-held, middle market companies that don’t have audited financial statements. Many have their financial …

What Is the Guideline Public Company Method in Valuation?

The Guideline Public Company (GPC) Method is one of the more popular valuation methodologies because people often hear about it in the news or in presentations. This method identifies prices for individual shares of publicly traded companies that are subject to the same industry dynamics as the subject company (the company you are trying to …